Should You Be Paying Quarterly Tax?

If you work freelance or contract jobs and don’t pay taxes quarterly, you might be penalized..

What many freelancers don’t know is that aside from annual taxes, the IRS expects a quarterly tax payment as well. This means that roughly every three months, freelance and contract workers have to pay tax on their income or risk penalties in the form of fees and interest on their annual tax returns, plus inflation. There are however, exceptions to this rule, as well as easy-to-use tools to help calculate what your quarterly tax payment should be- read on to learn more.

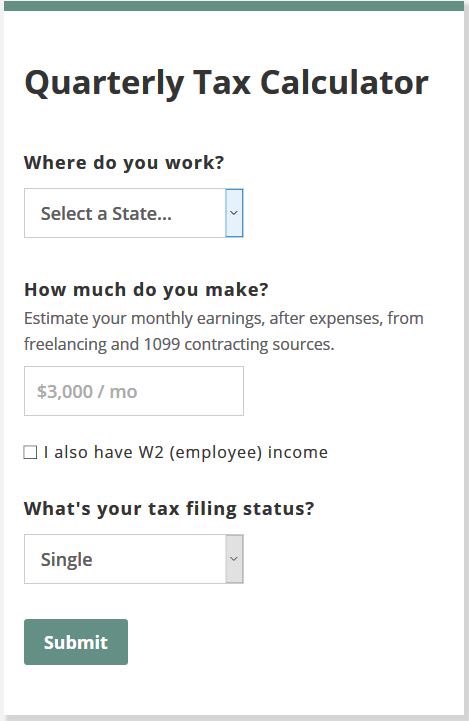

Quarterly Tax Calculator

By using the Quarterly Tax Calculator developed by the forward thinking financial service team at Keeper Tax, you can estimate your quarterly tax payment amounts. The calculator uses the latest state and federal tax brackets, plus standard deductions to give you a personalized, accurate forecast. While it does take into account any W2 work you have, it does not factor in child nor education related expenses. If you have either of these expenses, the amount quoted by the tax calculator will be higher than what you actually need to pay.

In my opinion though, it’s better to be conservative when forecasting spend- to avoid negative surprises. You can learn more about the Quarterly Tax Calculator on the Keeper Tax website, as well as find other resources for how and why you should be paying quarterly taxes. To actually submit your quarterly tax payment, you need to go through the IRS website.

Penalty

It’s important to know if your financial position actually requires submitting taxes quarterly, as well as the penalty for not doing so. The general rule of thumb is that if you expect to owe less than $1000 USD in taxes for the year (after subtracting your federal income tax withholding), then you’re probably safe and don’t need to pay quarterly. If you expect to pay more than $1000 USD then you need to pay quarterly tax- and there’s a penalty if you don't.

The penalty for not paying quarterly tax is typically 7-9% of the underpayment amount. So for example if you make $50,000 per year and owe $10,000 in taxes, this would come out to around $700 in penalty fee. Depending on how much you make as a contract/freelance worker, this number could even be more. It isn’t worth the headache of unexpected fees, when there are handy tax tracking tools like Keeper Tax available!

Exceptions

There are a few exceptions to paying quarterly tax as a freelancer. If you earn (revenue) less than $12,000/year or most of your income comes from a W2, you might be off the hook. More info can be found on IRS website but when it comes to finances and paying the government, it’s better not to take risk. Do your research and calculate your quarterly tax payments using the Keeper Tax calculator today to prevent unexpected penalties tomorrow.

If you’re one of the lucky ones who have to pay quarterly taxes, there are tons of useful tools on the market that help track expenses. Supplementing their quarterly tax calculator, Keeper Tax also provides forward thinking tools to manage freelance/contract worker expenses. Their flagship application is an intuitive, highly accessible and robust expense tracking tool that connects to your bank account and texts you whenever costs are incurred. From there, you can choose how to classify the expense and later pull a report of all your spend- super useful if you’re on the go! You can learn more about Keeper Tax technology in this other Mod.

If you found this Mod useful, please consider sharing using the social media links below. Any questions or comments? Let me know on Twitter!