5 Tips to Saving Money on Your Home Mortgage

Buying a house is one of the most expensive ventures. Most people opt to save for a down payment and apply for a mortgage to offset this payment..

Despite being the most expensive monthly payment, a mortgage is a worthy investment that will help you secure yourself and your family for retirement. In addition, there are a few tactics that you can use to save money and reduce your monthly mortgage payments. Here are some tips you can use.

How to Save Money on Your Home Mortgage

1. Refinance Your Mortgage

Refinancing involves getting a new loan and paying off the current one. The new lender offers you a new loan with a fresh set of terms and clears the existing one. Individuals go for refinancing primarily to get lower interest rates which translates to lower monthly payments, saving lots of cash.

You can also refinance if you need to get some extra cash, known as cash out refi. With this option, the borrower uses the cash to pay off the loan and gets some extra cash for other purposes. This is a great option if you have too much debt. You can use the cash out to pay off your credit cards which increases your credit score.

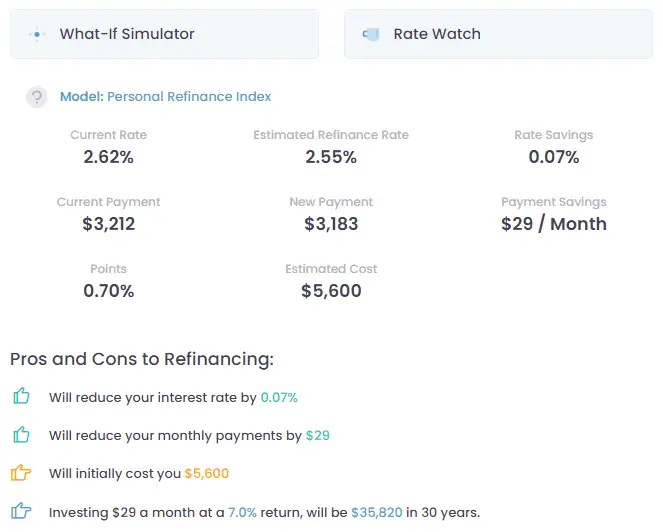

Before you apply to refinance, we recommend starting with a tool like Refidesk. The platform provides a spam free way to get information about your options and provide tools to help you measure the costs and benefits. The personalized quotes received from Mortgage Brokers, all competing for your business, appear on Your Mortgage Dashboard and put you in control. We didn’t receive emails, phone calls or texts spamming us to refinance.

2. Pay Extra Payments

If you can afford it, make extra payments on your monthly mortgage. This strategy will enable you to pay the loan in less time and pay less interest in the long term. You can also make large one-time payments if you run into large amounts of cash, such as an inheritance.

You can do this by making bi-weekly payments instead of monthly. The extra regular payments reduce the time you'll take to pay off the total loan amount and save you money. However, before signing up for these types of schedules, consult your lender to ensure no extra fees are charged. You can use Refidesk’s What-If Scenario tool to see the effects of making extra payments. One key thing to keep in mind is the opportunity costs of paying extra on your mortgage versus investing the savings in something that could return higher than your interest rate.

3. Adjust Your Mortgage

There are ways to modify your loan if you are going through financial trouble. Depending on the lender and systems in place, you could get a reduced interest rate, extended loan periods, lower monthly payment, or leeway not to pay part of the loan principal. In addition, you can choose to switch to Adjustable Rate Mortgage if you are currently on a fixed-rate mortgage and don't plan to stay in your home for more than five years. This program will give you a lower interest rate.

4. Avoid Private Mortgage Insurance (PMI)

PMI is the amount you are expected to pay if your down payment is below 20%. This insurance protects the lender and mortgage investor if you default on your loan. The PMI payments increase the amount of cash you'll need to pay on the mortgage. Therefore, to avoid paying extra fees on the mortgage, it's best to raise enough deposits when applying for the loan. You can achieve this by shopping for more affordable houses that you can afford to meet the 20% down payment.

Everyone has a different situation and it’s always great to just ask people that know what they are talking about and know what is possible. Depending on your situation you can ask mortgage brokers what they think in the Just Ask section of the Refidesk Community. Once you get the mortgage, you can use a tool like Refidesk to track your refinance options and take control of your finances. It’s always nice to have a historical perspective.

5. Avoid Penalties

Defaulting on your mortgage or loan will make it more expensive, especially if you accrue penalties. Before signing the mortgage agreement, make sure you read the fine print and have all the necessary information regarding extra fees if you run into financial trouble or make late payments. If you have accrued too much debt from other investments or credit cards, you can join the Refidesk Community and see about available options. You can get tips and the pros and cons of getting cash out refi to help you settle your loan and other debts.

Factors to Consider Before Refinancing

Refinancing is a huge financial decision. Before taking the step to apply for refinancing, here are some factors that you should consider.

- Current Interest Rates- Most people go for refinancing to get lower interest rates. If the new rate is higher than what you already have on the current mortgage, refinancing is not a good option.

- Credit Score- To get a lower interest rate, you'll need to have an excellent credit score. Therefore before applying for refinancing, check whether your rating is in order. Using your current credit score, you can see what option you have through most refinance providers.

- Property Ownership- Before applying for refinancing, consider how long you plan to own the home and the opportunity costs. If you plan to sell the house in a few years, you'll need to analyze whether the new loan is worth it and whether you'll recoup any cash.

How to Get Your Mortgage Refinance Rates

Financial decisions that involve heavy investments such as a mortgage need constant monitoring. Therefore, you'll need accurate figures and rates in real-time if you want to apply for refinancing. You can easily get this information from the Refidesk Mortgage Dashboard, which could help you pay off the loan earlier and save money. With accurate rates, you can easily compare the pros and cons of refinancing and decide on the best course of action. Therefore, you should use a reliable company to get information and data to guide you on the refinancing process.

Summary

Mortgages are an essential part of purchasing homes. Most first-time buyers depend on this type of financing to get their dream home. Mortgage refinancing has become popular among borrowers. The lower interest rates have created an opportunity for homeowners to re-evaluate their loans and decide whether they need a new loan.If you are considering refinancing, you can get personal quotes and the current rates in the market, and whether it's a good idea from Refidesk. Sign up to the Mortgage Dashboard for free to take control of your finances, today.

If you enjoyed this Mod, you might like to read more about how to build your own Uber for X platform! Please consider sharing this Mod using the social links below.